Although the economy as a whole might still be reeling from the effects of the COVID pandemic, this week’s IAB Brand Disruption Summit revealed that many consumer brands are doing remarkably well. Brands that appear to be “cleaning up” over the past six months include both legacy brands like Clorox and names we had never heard of, like Glossier and Warby Parker that jumped to the head of the line.

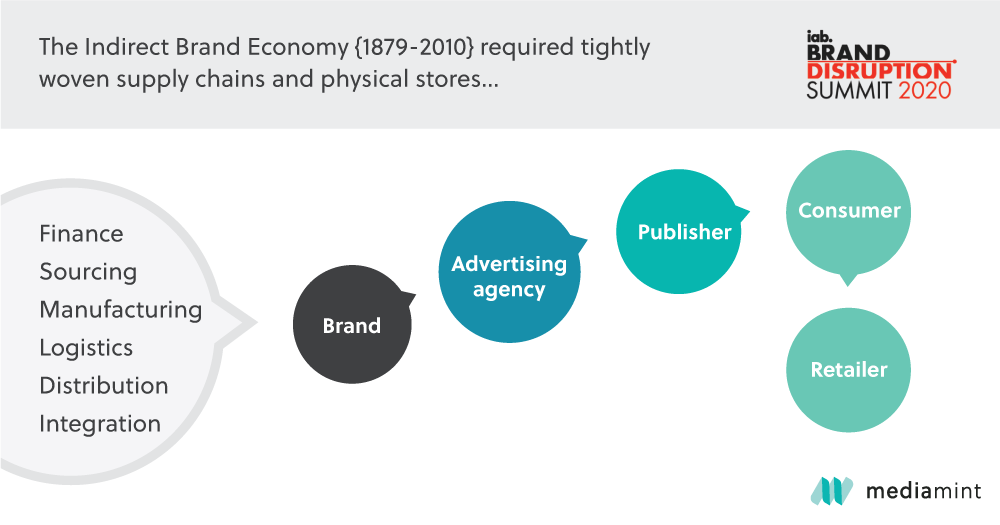

For the past few years, rapid evolutionary change had already been shifting consumer shopping habits online. But indirect brands, those who made products to supply stores, were still the major players before COVID. From 1879 when Procter & Gamble invented Ivory Soap, to 2019, when e-commerce accounted for 16% of consumer purchases, there were still two separate chains in the retail business—the supply chain that manufactured the product and the value chain, which distributed and marketed the product. Now, in many cases, those have been transformed into one.

Source: 2020 IAB Brand Disruption Summit

That’s because in 2020, the COVID economy, according to data from the IAB, collapsed five years of transition from a store-based economy to a direct brand economy into one, thrusting us to a storeless future. This year has already seen 25,000 store closings, and many companies converting their storefronts into digital fulfillment centers for the newest retail business model, “BOPIS” (Buy Online Pickup in Store).

BOPIS is the trendy word for consumers who want immediate delivery of something they’ve bought online. Until now, this could only be done through Amazon, but new market entrants include Walmart, Target, and BestBuy. Brands who couldn’t keep up, like old stalwart Penney’s or Brooks Brothers, simply went bankrupt.

The good news is that consumers are buying. Digital retail spending is up 30%, and while there were only 2 days in 2019 where digital spending totalled more than $2 billion, by August 2020 there had already been at least 20 before the holidays. E-commerce is now 23% of consumer spending with most categories becoming predominantly digital.

Source: 2020 IAB Brand Disruption Summit

More Room for Brand Disruption

According to IAB, the more consumers adopt e-tail, the more they will favor newer brands over legacy brands. For the last 150 years, new brands were limited by the amount of shelf space in stores, and that shelf space sold for a premium. For example, in the “old economy,” (meaning last year!) the top 20 cosmetics brands accounted for 90% of retail sales. But in the new DTC world, smaller brands are 86% of online retail.

If you need examples, consider Chewy’s, which was bought a while ago by PetsMart and has quickly outstripped its acquirer to become a $5 billion brand. Likewise, Wayfair is now worth six times the value of Crate and Barrel and is a $9 billion brand. Madison Reed, a company with a 78% product margin, saw revenue increase 10-12x. To keep up, legacy brands like Ocean Spray and Colgate launched DTC product lines, and Nike is closing 9 wholesale accounts to double down on DTC. By 2025, the brand expects 30% of its revenue to come from e-commerce. What stores remain will exist to enhance the digital experience, not the other way around.

Direct to Consumer Brands: Don’t Worry About Third Party Cookies

The competitive edge for direct to consumer companies is first-party data. With the rise of storelessness, privacy regulations, and browser restrictions, marketers must stress investment in first-party data, and large cloud companies like Adobe and Oracle have built Consumer Data Platforms for the likes of Starbucks, whose data becomes priceless as brands become data companies that make products, rather than product companies that may have some customer data.

Production Supply Chains and Marketing Supply Chains are Now One

And what makes this possible?

The rapid growth during the pandemic of streaming video. Weekly video streaming grew 78% year on year in Q2 of this year, and Twitch streaming hours alone grew 123%. Streaming audio has also surpassed radio, and social media use has climbed to over an hour and a half per person per day.

The medium, the player, the hangout, and the store are now the same thing.

At the end of the day, investment in augmented reality will triple in the next five years as consumers try to see how furniture will fit into their existing homes or how attractive a new hair color or makeup will be. Again, the legacy brands had better hop to it because Shopify, home to tens of thousands of e-commerce stores, is already offering its customers 3D video.

Our own prediction: retailers will have to be publishers, and publishers will have to be retailers within the next few years.

Recent Comments