Choosing a DSP in 2025: Key Factors to Consider

Why This Matters Now

Digital advertising used to be about reach.

Now it is about connection: between systems, signals, and screens.

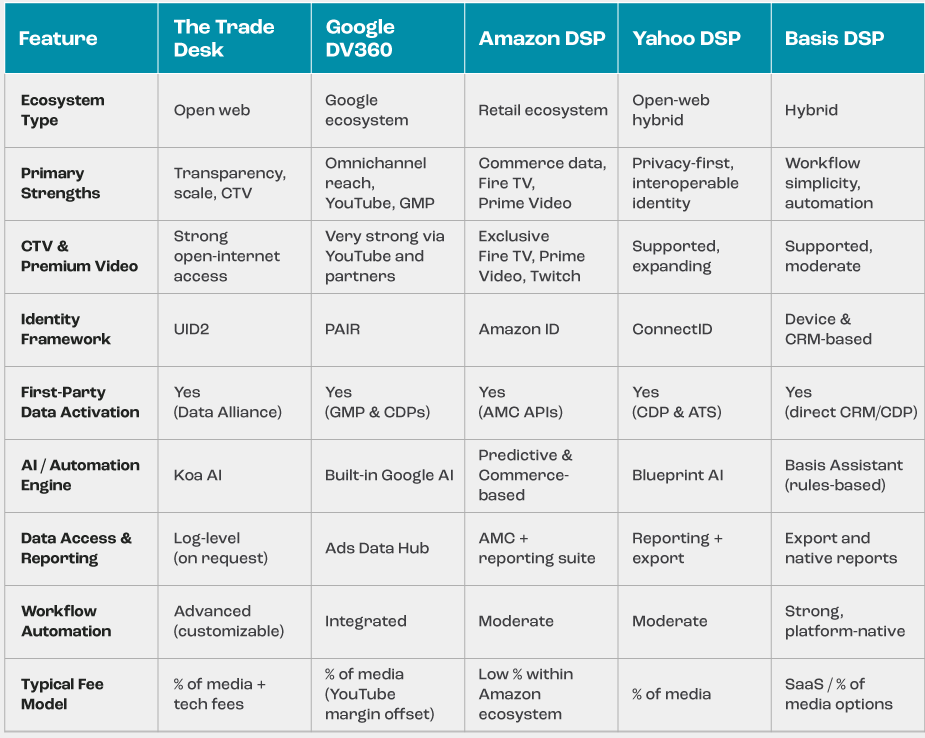

Five platforms shape how that connection happens today: The Trade Desk, Google DV360, Amazon DSP, Yahoo DSP, and Basis. Each has its strengths, but no single platform can do it all.

Cookies may still exist, but their power is fading. The industry is shifting toward identity frameworks, first-party data, and privacy-safe collaboration. Privacy is now the law, not a preference. Connected TV has become the new center of attention. And AI is quietly making more campaign decisions than most teams realize.

So the question is not “Which DSP is best?”

It is “Which mix helps us work smarter, faster, and with more clarity?”

The Trade Desk: Transparency at Scale

The Trade Desk remains the backbone of the open internet. Its Unified ID 2.0 continues to anchor identity in a post-cookie world, while Koa AI powers performance forecasting across premium web and CTV inventory.

In 2023, The Trade Desk launched OpenPath, a direct integration between advertisers and publishers that eliminates hidden fees and reduces bid duplication. It gave advertisers cleaner supply chains and publishers more transparent yield.

In 2024, it introduced Kokai, an AI-driven buying platform that blends identity, automation, and real-time insight into a unified system. Kokai embodies The Trade Desk’s long-term vision: intelligence built on transparency.

As pricing models evolve, The Trade Desk faces new competition. With Amazon experimenting at near-zero take rates, value will shift from infrastructure to intelligence. The Trade Desk’s advantage remains in data clarity, not price.

Best for: Advertisers seeking transparency and performance across the open web.

Takeaway: The Trade Desk defines what open-web scale looks like when paired with real transparency.

Google DV360: Scale with Boundaries

DV360 sits at the heart of the Google Marketing Platform. It connects YouTube, Search, Display, and Gmail inventory in a single buying surface.

Its strength is scale. Creative management, audience planning, and cross-channel reporting are built-in. But this convenience comes with limits. Optimization happens within Google’s walls, and data visibility remains controlled.

DV360’s future rests on PAIR and the Privacy Sandbox, which aim to preserve targeting accuracy without third-party cookies. And as DSP margins compress, Google can afford to keep prices low, offsetting fees with revenue from YouTube and other owned properties.

Best for: brands already invested in Google’s ecosystem.

Takeaway: DV360 is unmatched for scale, but its advantage begins and ends within Google’s walls.

Amazon DSP: Commerce, Clarity, and the 1% Shockwave

If intent is the heartbeat of advertising, Amazon DSP has the strongest pulse.

It uses purchase, browsing, and search data to reach audiences ready to buy.

Through Prime Video, Fire TV, and Twitch, Amazon connects upper-funnel awareness to measurable lower-funnel results. Amazon Marketing Cloud (AMC) turns impression data into insight, showing how exposure leads to purchase.

Now, Amazon is changing the economics of programmatic advertising.

Reports suggest its DSP operates at roughly a 1% take rate, compared to the 10–20% fees typical across the industry. The signal is clear: infrastructure should be cheap; intelligence should be valuable.

For Google, this model is sustainable because its profit lies elsewhere. For independents like The Trade Desk, it poses a direct challenge. Infrastructure is becoming a commodity. The differentiator now is what a DSP can think, not what it can charge.

Best for: Brands seeking closed-loop performance and measurable outcomes.

Takeaway: Amazon DSP is not just lowering fees; it is redefining what a DSP should earn its keep for – results, not access.

Yahoo DSP: Privacy as a Performance Strategy

Yahoo DSP has become one of the most identity-resilient platforms in the market. Its ConnectID achieves some of the highest match rates across the open web, enabling accurate targeting even as cookies fade away.

Powered by Yahoo’s Identity Suite, the platform connects addressable and contextual audiences. Integrations with LiveRamp ATS, Comscore ID-Free Audiences, and multiple SSPs make Yahoo a flexible option for both advertisers and publishers.

Its AI tools, Blueprint and Omniscope, add forecasting and real-time optimization, while the Conversion API enables full-funnel measurement.

Yahoo may not match the scale of DV360 or the commerce strength of Amazon, but its balance of privacy, interoperability, and performance makes it one of the most adaptable DSPs today.

Best for: Advertisers prioritizing privacy, identity consistency, and transparent reporting.

Takeaway: Yahoo DSP turns privacy from a constraint into a competitive advantage.

Basis: Workflow First, Complexity Second

Basis focuses on simplification. It combines planning, buying, billing, and reporting within one system, reducing operational drag for lean teams managing multiple clients.

It does not own exclusive inventory or identity frameworks. Instead, it wins through automation, clean UI, and human control. Its AI co-pilot, Basis Assistant, is shaping into a quiet revolution in workflow automation, helping teams plan and adjust campaigns faster without adding headcount.

Best for: Independent agencies and mid-market advertisers that value efficiency.

Takeaway: Basis makes programmatic feel less like management and more like momentum.

The Real Shift: From Scale to Outcomes

Modern advertising no longer lives inside one platform. Each DSP offers a unique advantage: scale, commerce, identity, or workflow.

The winners in 2025 will be the teams that know how to make them complement each other.

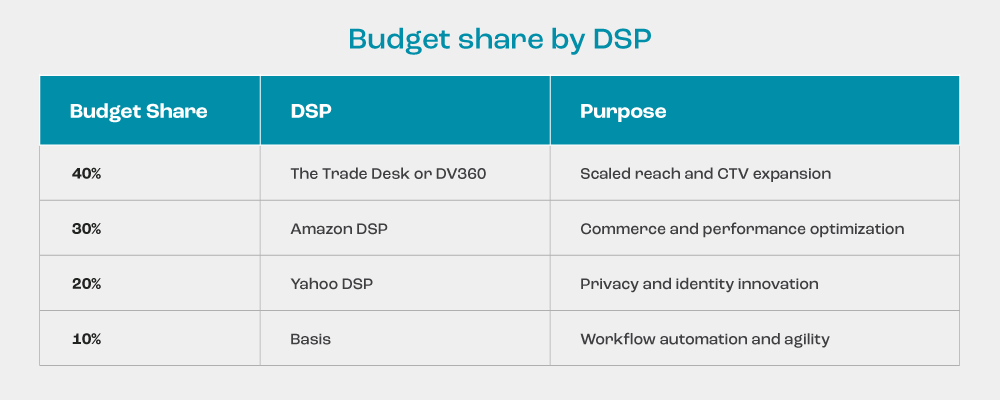

Use The Trade Desk for open-web transparency, DV360 for omnichannel scale, Amazon DSP for performance and closed-loop commerce, Yahoo DSP for privacy-forward precision, and Basis for automation and reporting flow.

Takeaway: Orchestration, not exclusivity, is the new competitive edge.

AI and Accountability

AI powers much of what DSPs do today – forecasting, pacing, and creative rotation.

But speed without clarity creates blind spots.

The next evolution will favor explainable AI: systems that can show why a bid was made, why a model changed course, and how performance was achieved.

Automation without accountability is noise.

Takeaway: Trust will shift from how fast DSPs optimize to how well they explain.

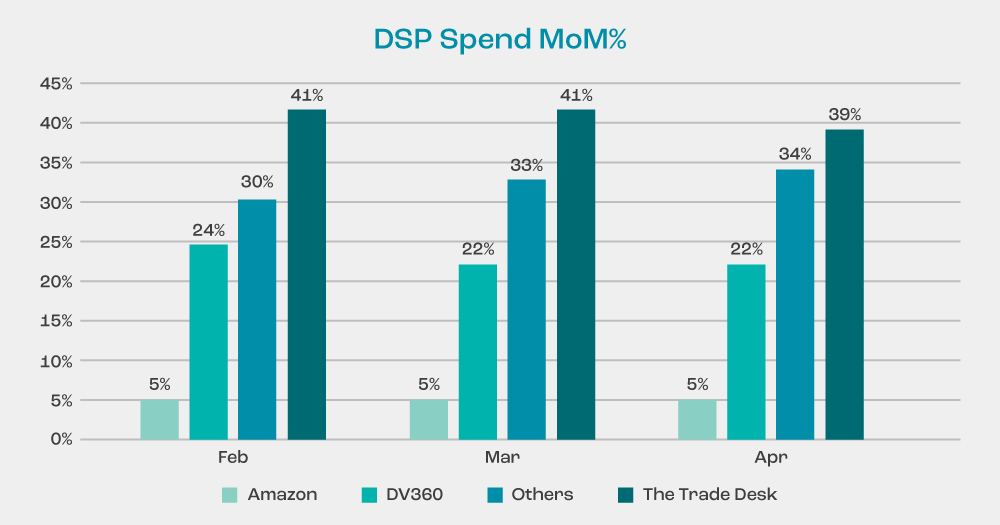

Market Momentum: MoM DSP Spend Trends (Feb–Apr 2025)

Programmatic spending patterns reveal how advertisers are adapting to platform maturity, identity shifts, and pricing changes. Between February and April 2025, all five major DSPs showed distinct momentum curves reflecting their strategic strengths.

The chart below shows month-over-month (MoM) spend growth across The Trade Desk, Google DV360, Amazon DSP, Yahoo DSP, and Basis.

The Trade Desk and DV360 remained stable, reflecting their established base and slower but sustained CTV growth.

Budget Balance for 2025

Diversify by function, not by platform.

A resilient DSP mix protects against both identity change and pricing disruption.

What to Try Next

Small experiments often reveal the biggest truths.

- Compare UID2 and ConnectID for match rates and conversion quality.

- Feed offline conversions into Yahoo’s CAPI for full-funnel lift.

- Test Amazon DSP’s 1% fee structure against open-web CPMs.

- Pilot Kokai’s predictive pacing on The Trade Desk.

- Use Basis Assistant to streamline repetitive operations.

Each test compounds insight – and insight compounds advantage.

MediaMint’s View

Technology choices matter less than how they work together.

At MediaMint, we see DSPs as components of one connected workflow: data in, insight out, and learning back in again.

Our role is to make that cycle faster and more transparent so that advertisers, publishers, and partners spend less time managing complexity and more time driving growth.

The future of programmatic will not belong to any single DSP.

It will belong to those who can make all of them work in sync – open, intelligent, and accountable.

Comment